[ad_1]

Mumbai: Deposit growth is again outpacing credit expansion while expectations are building for a policy rate cut in the current half of the fiscal year, but the rates that banks offer for parking cash with them are likely to remain elevated for some more time.

Deposit rates get repriced with a lag and private capital expenditure is expected to come on stream, boosting loan demand, so banks may have to continue with higher deposit rates to attract savers, said bankers and sector experts. They also noted that the pace of deposit growth was still weak though it was faster than credit demand.

“We are looking at a return of private capex and with deposit mobilisation continuing at a slow pace, term deposit rates could remain high for some time to fund that credit growth,” a banking official said.

Some also believe that fixed deposit interest rates may even go up as a few banks that are facing tight liquidity conditions could increase their rates to attract depositors.

“The lending rate increases are more or less expected to plateau hereon, but the impact of deposit rate increases will continue to flow through to the bank balance sheets for some more time. This is because deposit rate hikes are typically applicable to fresh deposits and renewals while the earlier contracted deposits do not get repriced immediately,” said Krishnan Sitaraman, chief ratings officer and senior director at Crisil Ratings. “We do also expect rate cuts to happen in the second half of this year. Those will get reflected faster in the loan book vis-a-vis the deposit book because the loan book is largely floating in nature while repricing of deposits happens with a lag.”

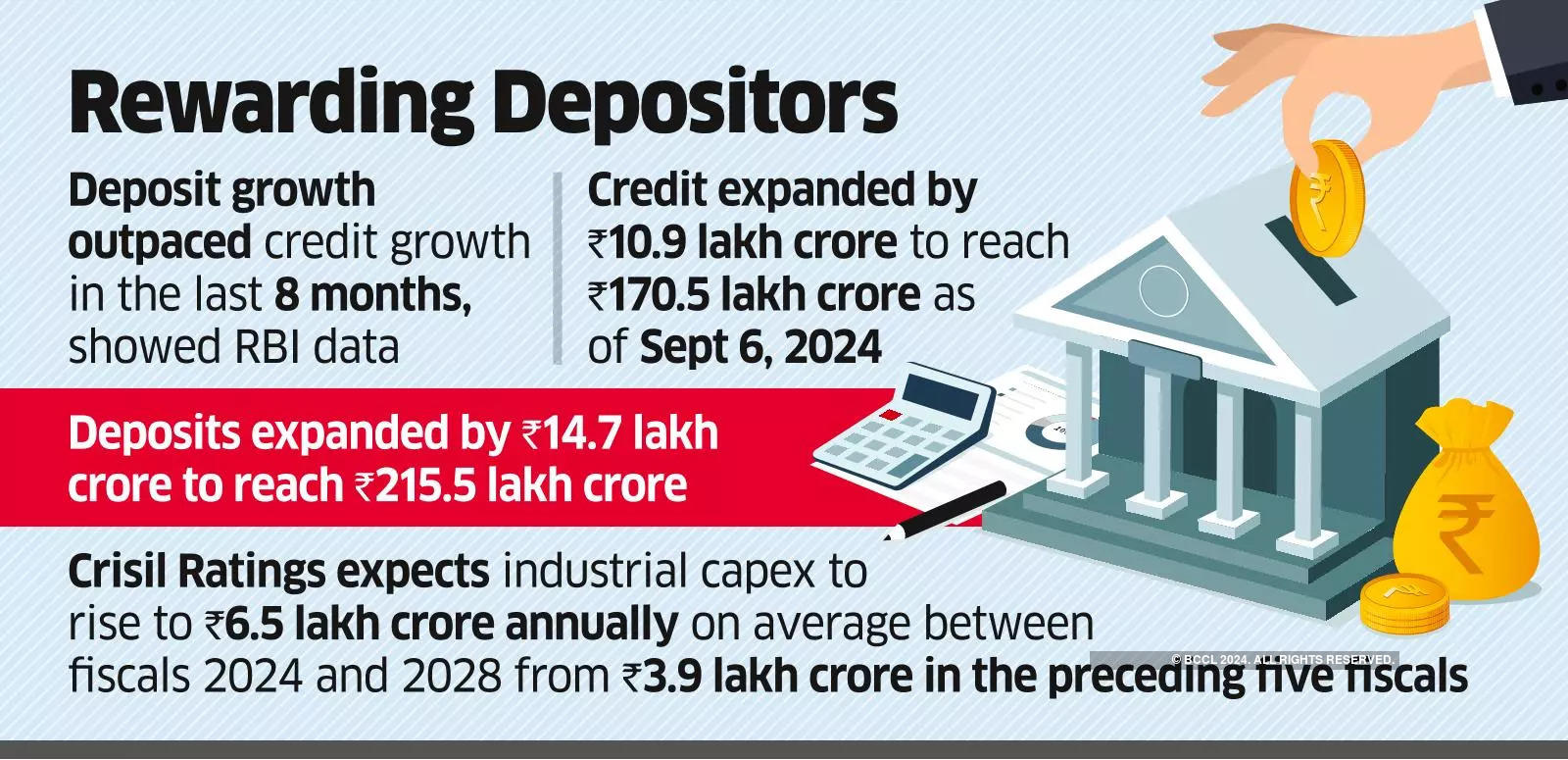

Deposit growth at banks has outpaced credit growth in the last eight months – credit has expanded by 6.8% to ₹ 170.5 lakh crore as of September 6, 2024, while deposits have increased by 7.3% to ₹ 215.5 lakh crore.

Experts believe higher rates on deposit rates may continue as banks would need capital to fund private capital expenditure.

As per a Crisil estimate, brownfield projects requiring more than ₹6.5 lakh crore in private capital expenditure are expected to be in the pipeline and banks would need capital to fund these. In the last five years, private capex has been less than ₹3.5 lakh crore annually on average.

Experts are seeing brownfield capex return to auto, cement, steel and infrastructure-linked sectors. Activity is also seen in the 14 sectors linked to the government’s production-linked incentive schemes.

“Overall, gross fixed capital formation exhibited robust growth of 7.5%, surpassing the previous quarter’s performance,” said Rajani Sinha, chief economist at Care Ratings. “This is despite a contraction in the Centre’s capital expenditure in Q1. This suggests increased capex by households and the private sector.”

A recently released study by the Reserve Bank of India showed that private corporate capex momentum in India remained strong with FY24 capex funds sanctions at ₹5.7 lakh crore, up 61% from the previous year. Banks accounted for 69% of total funds tied up in FY24, followed by external commercial borrowings at 30%.

[ad_2]

Source link