[ad_1]

The stock of Karur Vysya Bank (KVB) has shown resilience over the past two months, gaining a modest 2% since July 18 when it declared the June quarter result compared with the weakness in the BSE Bankex, which has lost 1% during the period amid pressure on margins and rising regulatory oversight. The bank has among the lowest loan-deposit ratio of 83% and among the highest liquidity coverage ratio of 185%, which should help in sustaining a double-digit loan growth. Analysts have raised one-year price targets by over 8%.

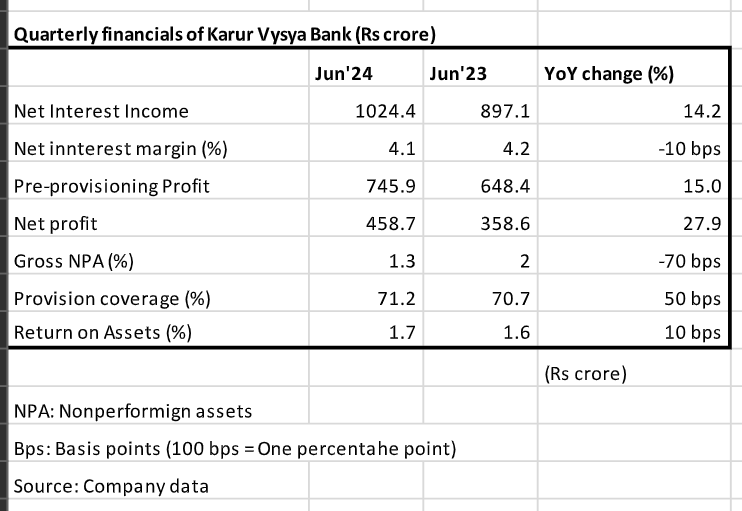

The mid-tier bank has been exhibiting sustained growth in retail as well as commercial loan book, strong net interest margin (NIM) and stable asset quality. It reported 21% and 22% year-on-year growth in retail and commercial loans respectively for the June quarter. The retail segment contributed 24.2% to the gross advances compared with 23.3% in the year-ago quarter. To address the issue of slowing deposit growth at the sector level, the bank has taken steps to augment its presence by planning to add over 100 branches in the current fiscal year. Each of deposits and advances grew by 4% sequentially in the June quarter to Rs 92.349 crore and Rs 77,710 crore respectively. Year-on-year basis, deposits and advances rose by 14% and 16% respectively.

A conscious effort to reduce corporate loan book and improve high yielding loans in other segments is expected to help the bank retain NIMs at around 4% in the first half of the fiscal year. The share of corporate loan book fell to 17.6% in the June quarter from 20.2% in the year-ago quarter. A 12 basis point increase in the cost of deposits during the latest June quarter was compensated by an equal amount of rise in the investment yield. NIM marginally contracted to 4.13% from 4.19% a year ago.

The gross nonperforming asset (GNPA) ratio fell by 67 basis points year-on-year to 1.3% following lower slippages and recoveries in the technically written off accounts. The bank expects to keep the GNPA below 2% in the coming quarters. At 0.56%, credit cost showed a moderation compared with 0.65% in the previous quarter. The bank expects credit cost at 0.75% for FY25.

“KVB has seen remarkable transformation under the current management with steady growth and superior return on equity (RoA). Overall loan growth has been steady at around 15% year-on-year for the last eight-nine quarters,” said ICICI Securities in a report. The brokerage has raised the price target to Rs 270 from earlier Rs 250 valuing the stock at 1.6 times the FY26 expected book value. The stock was traded at Rs 211 on Thursday on the BSE.

[ad_2]

Source link