[ad_1]

Lenders have strengthened credit assessment processes, including social media analytics, before extending consumption loans to Jan Dhan account holders, people familiar with the development said.

While there has been no formal government directive in this regard, banks are being cautious, they said.

“We are partnering with fintechs on various models of credit assessment including social media mapping, which gives an indication of location besides insights into other spending activities used to analyse customer risk behaviours,” said a bank executive.

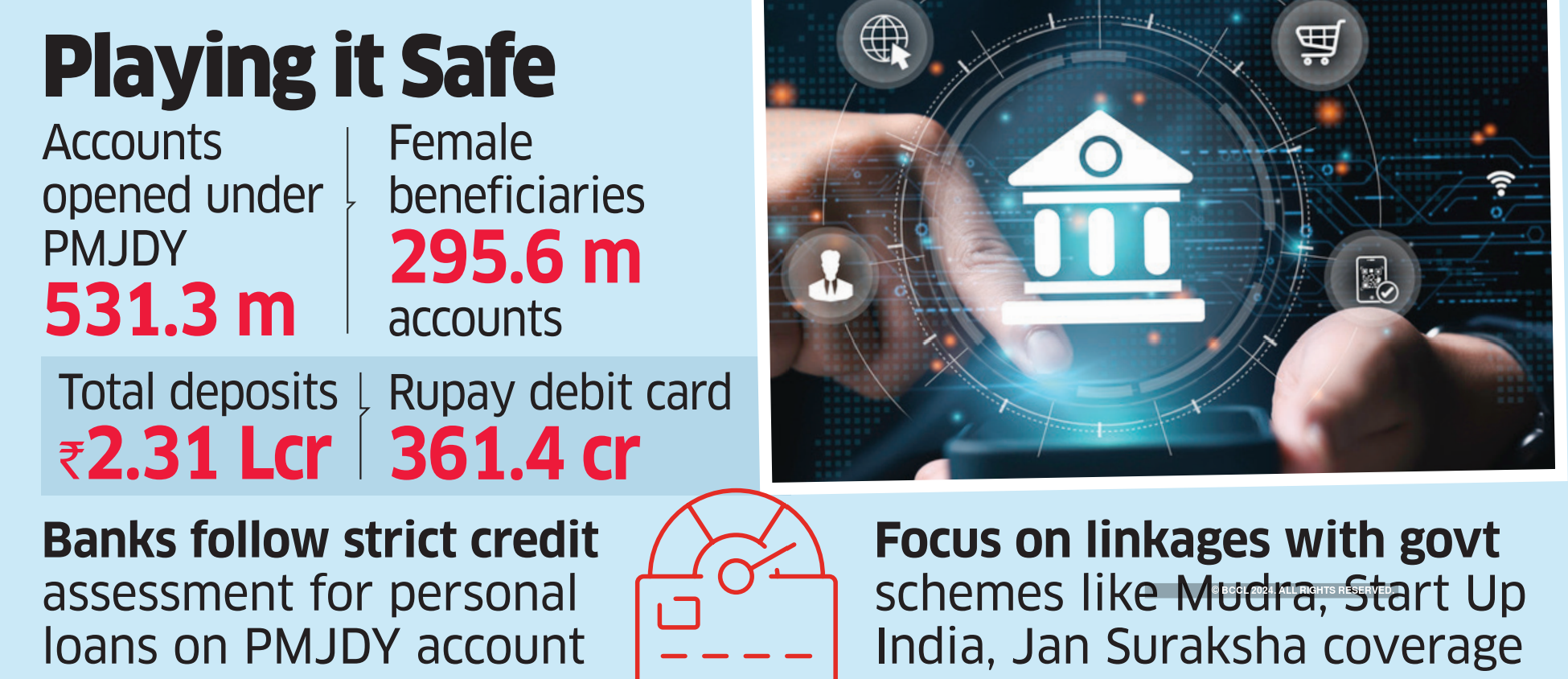

The average balance in more than 531 million PMJDY accounts is just Rs 4,352, according to the latest data. Around 67% of the accounts have been opened in rural or semi-urban areas, and 55% of the accounts belong to women.

Public sector banks are focusing on productive lending in this segment, like Mudra, and startup loans to promote entrepreneurship and job creation, said two senior bank executives.

“We are more oriented towards syncing such accounts with various government schemes, including insurance coverage under Jan Suraksha,” said one of them, adding that while there is no bar on offering personal loans, this is not the priority segment.

According to CRIF High Mark, an Indian credit bureau, as of March 2024, portfolio outstanding of personal loans stood at Rs 13.5 lakh crore, up 26% year-on-year. “There is 2.2 times growth in originations volume for less than Rs 50,000 ticket size loans from FY23 to FY24,” it said, adding that the stress in the Rs 1-2 lakh segment increased in March this year.

In August, the Reserve Bank of India (RBI) again cautioned banks on extending unsecured loans, noting that certain segments of personal loans continued to witness high growth.

“Excess leverage through retail loans, mostly for consumption purposes, needs careful monitoring from a macro-prudential point of view. It calls for careful assessment and calibration of underwriting standards as well as post-sanction monitoring of such loans,” RBI governor Shaktikanta Das said.

As per a recent report by ratings agency Care Edge, credit offtake increased 6.8% to Rs 170.5 lakh crore as of September 6, 2024, compared to December 2023.

“Personal loans and MSMEs (micro, small and medium enterprises) account for the majority of this growth. Meanwhile, sequential credit growth was 0.6%,” it said.

[ad_2]

Source link