[ad_1]

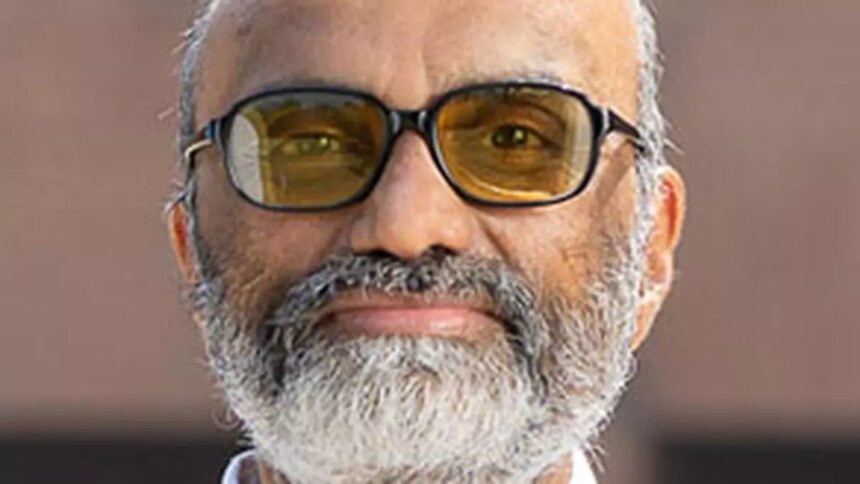

The Monetary Policy Committee’s external member, Jayanth R. Varma, cautioned that a real interest rate of 2 per cent creates the very real risk of turning growth pessimism into a self-fulfilling prophecy.

The Professor of the Indian Institute of Management, Ahmedabad, was the lone member of the six-member MPC to vote to reduce the repo rate by 25 basis points and to change the stance to neutral.

The real interest rate is the difference between the current policy repo rate of 6.5 per cent for FY25 and the projected CPI inflation of 4.5 per cent.

The MPC, which met on February 6, 7, and 8 , decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.50 per cent. The MPC also decided, by a majority of 5 out of 6 members, to remain focussed on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth.

‘No evidence’

“I do not believe that such a high real rate (2 per cent) is required at this stage to drive inflation down to the target of 4 per cent. It is true that economic growth is holding up well, but there is no evidence at all that the economy is overheating.

“Perhaps the majority of the MPC worry that the output gap has already closed and that the projected growth rate of 7 per cent for 2024-25 exceeds the growth potential of the Indian economy. I do not think that such growth pessimism is warranted,” Varma said. The RBI released the MPC minutes on Thursday.

The professor opined that if the potential growth rate of the economy is close to 8 per cent, then the economy is not at risk of overheating in 2024-25. A real interest rate of 1-1.5 per cent would then be sufficient to glide inflation to the target of 4 per cent, he added.

“It must also be borne in mind that the process of fiscal consolidation is projected to continue in 2024-25. This opens up space for monetary easing without risking an inflationary spiral.

“In my view, the time has come for the MPC to send a clear signal that it takes its dual mandate of inflation and growth seriously and that it would not maintain a real interest rate that is significantly more than what is needed to achieve its target,” Varma said.

Food price uncertainty

RBI Governor Shaktikanta Das noted that food price uncertainty remains a major source of volatility for the headline inflation outlook. Growing geo-political tensions and supply chain disruptions due to new flash points also pose further risks to the inflation outlook.

“The current setting of monetary policy is moving in the right direction, with growth holding firm and inflation trending down to the target. At this juncture, monetary policy must remain vigilant and not assume that our job on the inflation front is over.

“We must remain committed to successfully navigating the ‘last mile’ of disinflation, which can be sticky. As markets are front-running central banks in anticipation of policy pivots, any premature move may undermine the success achieved so far,” Das said.

MD Patra, Deputy Governor, observed that the outlook for the Indian economy remains highly sensitive to inflation risks.

“High inflation erodes purchasing power, especially for those least protected against the higher costs of essentials like food. Restoring price stability is beneficial for all,” Patra said.

Accordingly, monetary policy must remain restrictive and maintain downward pressure on inflation while minimising the output costs of disinflation. It is only when inflation subsides and stays close to the target lastingly that policy restraint can be eased, the Deputy Governor added.

External member Shashank Bhide (Honorary Senior Advisor, National Council of Applied Economic Research) said that given the implications of current elevated levels of food inflation to the overall inflation pressures and the prevailing strong overall growth, there is a need to remain focussed on achieving the inflation target in a sustained way.

“As we had observed in the December 2023 meeting, the transmission of increases in policy rates effected up to February 2023 is still incomplete. Therefore, it is critically important at this juncture to continue with the present policy rates so that the moderation in the inflation rate to the target is achieved in a sustained manner,” Bhide said.

[ad_2]

Source link